This is an unedited version of my article in the Sunday Times from July 28, 2013.

The latest news from the economy front both in Ireland and across the Euro area have been signaling some shallow improvements in growth outlook for the second and third quarters of 2013. However, the end game of a recovery currently building up will be a greater polarization of the real economy and little net new jobs creation. As supply of skills by indigenous workers remains mismatched to the demand for skills by exporting sectors, restart of exports-led growth of the future will not trickle down to the ordinary families. Meanwhile, long-term unemployment is hitting harder our older indigenous workers, and our entrepreneurship is in a structural decline. Responding to these problems will require a radical shift in the way we enable entrepreneurship, support professional labour mobility and increase investment in education and skills.

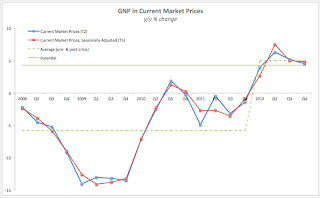

To see this, first consider the drivers for the latest improvements in the news flows. June Purchasing Managers’ Index (PMI) for Manufacturing in Ireland has finally reached just a notch above 50.0, signaling expansion for the first time since February 2013. Services PMI jumped to 54.9, marking 11th consecutive month of index readings above 50. Across the Euro area, Spanish Manufacturing PMI reached above 50 in June for the first time in 27 months. Italian PMI posted a rise for the third month in a row, although it remains below the expansion mark of 50.0. Germany's July composite PMI estimate for services and manufacturing hit a 17-month high at 52.8 and French estimate came in at 48.8 - an improvement on 47.4 in June.

Even though the end to the longest recession in euro area's history might be in sight, the recovery is unlikely to be strong. Euro area economies, Ireland included, genuinely lack sustainable drivers for growth. In addition, the processes of establishing new sources for future growth - new entrepreneurship and investment cycles – have been severely delayed both by the crises and by our policy responses to these crises.

In normal recessions, higher unemployment leads to higher involuntary entrepreneurship, as laid off workers deploy their skills and expertise into the market through self-employment and as sole-traders. In Ireland, in part due to tax hikes hitting the self-employed the hardest, this did not take place. According to the Enterprise Ireland report published earlier this month, the proportion of early stage entrepreneurs here has fallen from 8.1% average over 2003-2008 period to 6.1% in 2012. Ireland now ranks 18th out of 34 OECD countries in terms of entrepreneurship, just as the Government is expending millions on PR campaigns extolling the virtues of its pro-entrepreneurial policies and culture.

Beyond shrinking entrepreneurship, Irish labour markets are continuing to show signs of long-term, structural distress. The headline figures on Irish unemployment tell the story.

At the end of June 2013, there were 516,751 recipients of Live Register supports, including those in state and community training programmes. Some of the latter are involuntary in so far as they are linked to continued receipt of unemployment benefits. In June 2011, the same number was 517,187. The Government is boisterously claiming the economy is creating 2,000 new jobs per month. The same Government has spent hundreds of millions on enterprise supports and investment schemes, published series of programmes promising new jets in tens of thousands. Amidst this PR circus, the unemployment supports counts have declined by less than 500 over two years.

Based on the Quarterly National Household Survey data, we can take a more granular look into the jobs creation dynamics in the economy.

Between Q1 2011 and Q1 2013, the latest period for which data is available, total non-agricultural employment in the country fell by 9,200. In 12 months through March 2013, Irish economy added only 4,900 non-agricultural jobs. Some 19,000 shy of what our ministers in charge of jobs creation and enterprise policies allege. Controlling for health and education jobs, private sector saw destruction of 11,600 non-agricultural jobs since Q1 2011 when the Government came to power. Even in the booming Information and Communication services, overall employment fell by 1,100 in 12 months through Q1 2013, despite robust hiring in the exporting MNCs operating in the sector.

Underneath the surface, the trend is for displacement of Irish workers by age cohorts and by skills. This means that more and more foreign workers are taking up new positions created in sectors such as ICT and IFS to replace positions lost in domestic sectors. It also implies that older Irish workers are now being consigned to the risk of perpetual unemployment.

On the first point, while there is virtually no net new jobs additions in the economy, the positions that are being created to replace those being destroyed by the crisis, are getting progressively worse in terms of their quality. In the higher value-added private sectors, such as ICT services, professional, scientific, and technical activities, financial, insurance services and the likes, employment shrunk by 6,100 in Q1 2013 compared to Q1 2011 and by 900 compared to Q1 2012. Year on year there have been some 9,300 new jobs created in the top three professional occupations when ranked by earnings. However, more than half of these were part-time jobs. These are hardly the jobs that are attracting foreign talent into Ireland, suggesting that of the full time jobs in ICT and IFSC sectors created, the vast majority are taken up by non-Irish workers.

Regarding the last point, in June 2013, compared to June 2010, by age, the only cohort of Irish workers that saw a decline in Live Register numbers are those under the age of 35. All other age cohorts saw increases in Live Register participation. Between June 2010 and June 2013, numbers of long-term unemployed and underemployed rose 20% for workers under 35 years of age, 54% for workers of 35-54 years of age, and 106% for workers older than 55. In effect, we are currently assigning older workers to spend the rest of their working-age life in unemployment.

All of the above is best summed by the quarterly data on unemployment. At the end of March 2013, 25% of Irish workforce was either unemployed, underemployed or marginally-attached to the workforce, up on 23.7% in Q1 2011. Adding to the above those in state training schemes pushes the true broad unemployment rate in Ireland to 29% in Q1 2013, up on 26% in Q1 2011.

As I asserted at the top of the article, evidence shows that there is basically no net jobs creation going on in Ireland since Q1 2011. It further shows that older and predominantly Irish workers are experiencing an ever-rising risk of perpetual unemployment. Amongst the younger cohorts of workers, the main beneficiaries of the ICT and IFSC exporting sectors boom are temporary residents from abroad. Of the jobs still being added in the economy, majority are of low quality and cannot be relied upon to sustain long-term financial viability of Irish households. Lastly, skills mismatches between indigenous workers and exporting sectors demand are offering little hope that exports-led growth of the future will trickle down to ordinary families in Ireland.

The response to the above problem will have to be a structural shift in the way we support and treat entrepreneurship, professional labour mobility and investment in education and skills.

Currently, government policies overwhelmingly disfavor self-employed, indigenous entrepreneurs, and risk-taking professionals. In return, our policies promote development of tax optimizing FDI-backed large enterprises. Thus, early stage entrepreneurs face higher direct and indirect taxes than mature corporations and PAYE employees. Risk-taking, mobile, highly skilled professionals face lower quality and higher cost safety nets than immobile, old-skills-reliant tenured employees. Both mobile employees and entrepreneurs are also facing higher risks of unemployment, greater prospects of disruptive shocks to their incomes and larger exposure to health and family shocks. Meanwhile, for would-be entrepreneurs and flexible markets employees currently in underemployment or unemployment, life-long learning systems are costly to access and, with few exceptions, are of dubious quality.

These obstacles to increasing functional mobility of workers and human capital investments in our workforce can only be dealt with via a drastic, costly and disruptive reforms of our welfare system. In part, the Government is currently attempting to undertake some of these reforms, albeit against the rising tide of internal discontent between the coalition partners.

But the current reforms proposals are not going far enough. Specifically, we will need to separate unemployment supports from general welfare and make these supports available to self-employed and flex-employment workers at no increase in cost of provision to these workers. The test for accessing all benefits – unemployment insurance and general welfare – should include skills levels and the entire past history of employment and entrepreneurship. Thus, higher unemployment supports should be given to those who have contributed more in the past in terms of taxes paid and entrepreneurship or human capital investment efforts undertaken. Conversely, they should have lower access to welfare benefits. To afford the strengthening of the safety net at the front end of unemployment, we will have to cut back the general social welfare benefits for able-bodied adults.

Parallel to these reforms we also need to change the way we do business in the areas such as childcare and life-long-learning. The goal of such reforms should be to increase access and supports for families at risk of unemployment in the 30-35 years of age and older cohorts. One possible long-term improvement would be to incentivize on-shoring of corporate training services into Ireland by the multinationals, coupled with requirement that such services take on a set percentage of Irish workers for training purposes and apprenticeships. Another reform can see greater and more strategic engagement of multinationals with indigenous entrepreneurs and SMEs.

A deep re-think of our current policies on dealing with unemployment requires breaking down traditional siloes in public policy and management that exist between various departments. The last two years – filled with good intentions and loud policies announcements show that the strategies deployed to-date are not working.

Box-out:

The latest data from the Residential Property Price Index (RPPI) shows that Dublin property prices posted a year on year price increase of 4.15% in June and a 1.69% cumulative rise over the last six months. However encouraging this might sound, the data must be treated with caution for a number of reasons. Firstly, the main driver for the latest improvement in the RPPI was sales of Dublin apartments. These are highly volatile and are based on few transactions. Secondly, outside Dublin, the markets remain weak. Thirdly, latest mortgages data shows that while borrowing posted a cautious rise in the first half of 2013, mortgages affordability is falling. Lastly, current sales levels and valuations are not pricing in the upcoming wave of foreclosures (starting with Buy-to-Let markets around Q4 2013 and running though 2014) that will be required to deleverage banks balance sheets. The fact is: in June 2013 the All-Properties RPPI, was still down 1.5% on Q1 2012 average and is basically unchanged on December 2012-January 2013 levels. In other words, while pockets of strength might emerge in Dublin market, overall property market is currently bouncing at the bottom of the negative cycle, looking for a catalyst either up or down.